Buyer's vs. Seller's Market: Understanding When to Buy and When to Sell

Blog:Buyer's vs. Seller's Market: Understanding When to Buy and When to Sell

Posted on

|

Buyer's vs. Seller's Market:

|

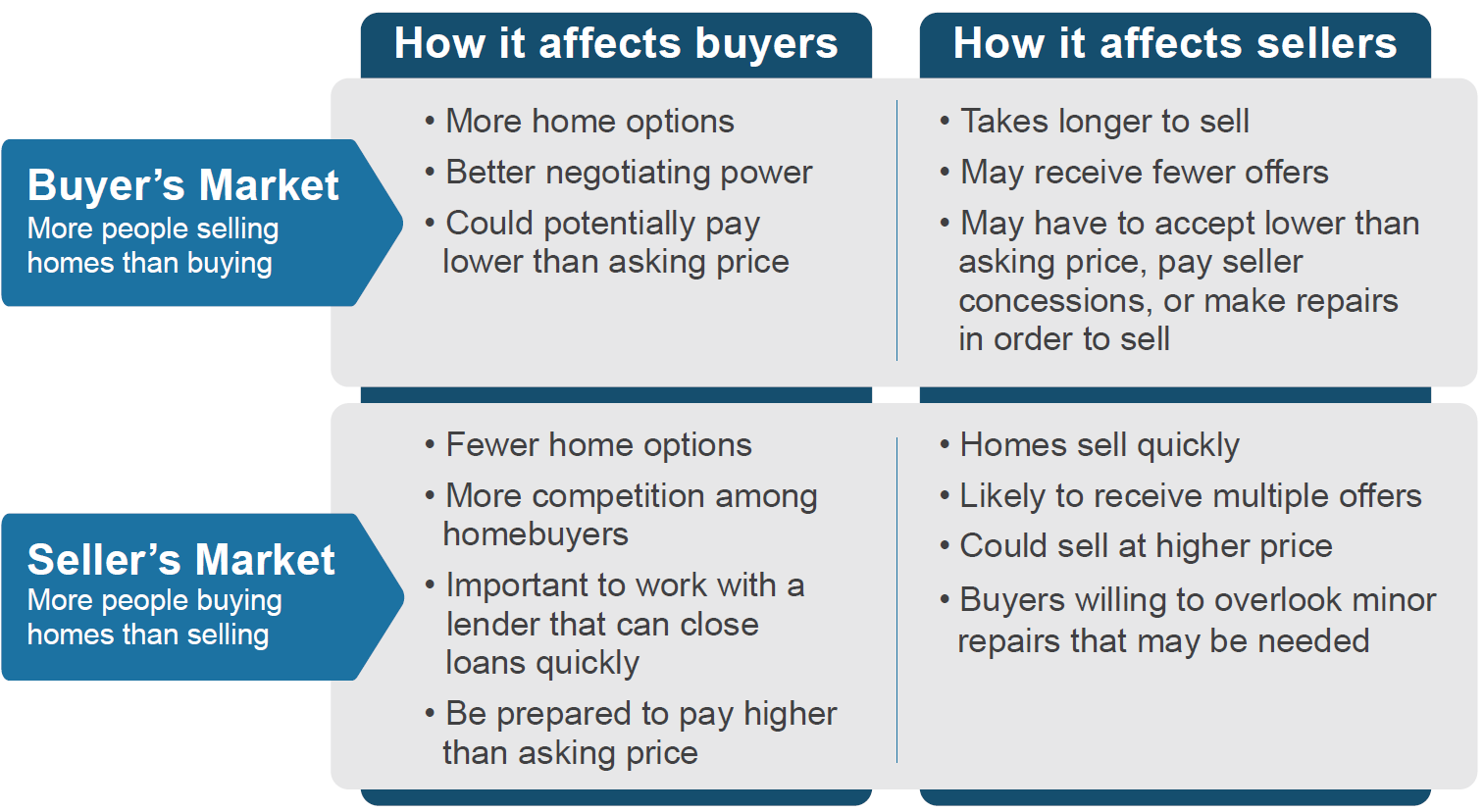

| The housing market fluctuates all the time, which can impact both buyers and sellers. One month it may be in your favor to sell (seller's market), and the next it may be in your favor to buy (buyer's market). |

| If you're contemplating buying or selling a home, you should understand how the housing inventory impacts you. |

|

|

| When is it a buyer's or a seller's market? |

| A buyer’s or seller’s market is determined by the housing supply, or how long it would take to sell all the houses currently for sale. |

| • Buyer’s market = More than 6 months’ housing supply • Seller’s market = Less than 6 months’ housing supply |

|

You can calculate this by dividing the number of homes for sale by the number of houses sold in a given month. For example, if 300 houses were for sale last month but only 100 sold, that would equal a 3 month housing supply (or seller's market). Keep in mind, the housing inventory may vary from city to city and may also depend on the time of year.

|

| If you're considering buying a home, contact TAM Lending today to discuss your home financing options. |